The "April Effect" — IRS Prosecutions Timed for Tax Season

As tax season approaches each year, the number of news stories on tax prosecutions seems to grow. What has been unclear is whether this is merely a function of heightened media interest in prosecutions for tax offenses when the public's attention is on filing their taxes, or if tax prosecutions are actually timed to peak during the early weeks of spring.

TRAC analyzed extensive case-by-case records of Department of Justice federal prosecutors over the past decade, classified by the month the prosecution was filed. The results of this analysis indicate that there is indeed an "April Effect," with prosecutions hitting their high point during tax season every year.

For example, the latest available data from the Justice Department show that during April 2008 the government reported 132 new prosecutions referred by the Internal Revenue Service (IRS). According to the case-by-case information analyzed by the Transactional Records Access Clearinghouse (TRAC), this number was up 31 percent over the previous month, and up 50 percent over the average for the prior ten months (May 2007 - February 2008).

|

| ||||||||||||||

|

||||||||||||||

These figures aren't unusual. The average number of prosecutions during April over the past decade was 190 and during March it was 140, while for the remaining ten months of the year it averaged only 96. Thus, on average April prosecutions were 36 percent higher than March, and just about double the level of prosecutions for the remaining ten months of the year (see Table 1).

The IRS is principally responsible for this "April Effect" because results of IRS criminal investigations provide the source for each of these recorded prosecutions. And although its criminal investigations continue throughout the year, the IRS recommends a disproportionately large number of cases to federal prosecutors as tax time approaches.

Once they receive a referral from the IRS recommending prosecution, federal prosecutors have to decide whether to go forward and file a prosecution, or decline to prosecute if their independent review of the evidence determines prosecution isn't warranted. But even prosecutors seem to be influenced by the approaching tax season. During April they decide that prosecution is warranted 66 percent of the time, whereas during the rest of the year federal attorneys decide prosecution is warranted only 52 percent of the time. Among the remaining months, March doesn't seem particularly unusual, with prosecutions being filed exactly half of the time. While it is possible that the IRS saves its strongest cases for tax season, it is also likely that federal prosecutors believe going forward with a tax case during April to be more in the "public interest" than during the rest of the year.

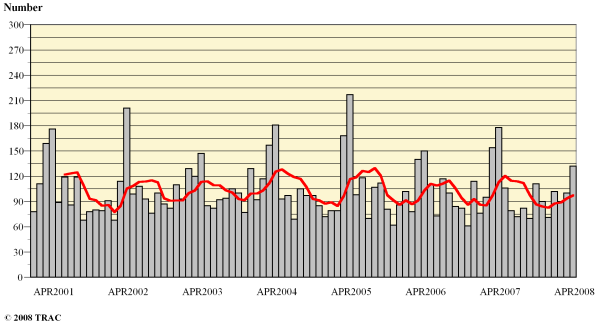

The persistence of the "April Effect" year after year is shown clearly in Figure 1, which covers the period since January 2001. The vertical bars in Figure 1 represent the number of prosecutions of this type recorded on a month-to-month basis. Consistently, the bar for the month of April is the highest each year, with the previous month's bar for March usually the next highest. The superimposed line on the bars plots a six-month moving average that smooths out natural fluctuations, showing the regular seasonality pattern. This same pattern of an April peak has been observed for each of the earlier years not shown in the chart.

Figure 1: IRS Criminal Prosecutions Since January 2001

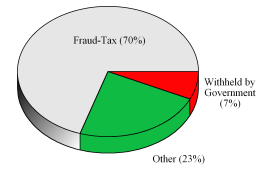

Figure 2: Specific Types of Prosecutions

What follows is a detailed description of prosecutions for the most recent tax season, April 2008. Prosecutions resulting from IRS referrals were classified by prosecutors into more specific types.

The largest number of prosecutions of these matters in April 2008 was for "Fraud-Tax", accounting for 70.5 percent of prosecutions. Category information was withheld from TRAC by the government for 6.8 percent of prosecutions. Prosecutions were also filed for "Fraud-Financial Institution" (3.8 percent), "Money Laundering-Drug" (3 percent), "Money Laundering-Other" (3 percent), and "Fraud-Federal Program" (2.3 percent). See Figure 2.

Prosecutions in U.S. Magistrate Courts

Top Ranked Lead Charges

In April 2008, 8 percent of cases for these matters took place in U.S. Magistrate Courts which handle less serious misdemeanor cases, including what are called "petty offenses." In the magistrate courts in April the most frequently cited lead charge was Title 18 U.S.C Section 286 involving "Conspiracy to defraud the Government with respect to claims." This was the lead charge for 18.2 percent of all magistrate filings in April.

Prosecutions in U.S. District Courts

Top Ranked Lead Charges

Table 2 shows the top lead charges recorded in the prosecutions of matters filed in U.S. District Court during April 2008 referred by the Internal Revenue Service.

| Lead Charge | Count | Rank | 1yr ago | 5yrs ago | |

|---|---|---|---|---|---|

| 26 USC 7206 - Fraud and False statements | 33 | 1 | 1 | 1 | More |

| 26 USC 7201 - Attempt to evade or defeat tax | 31 | 2 | 2 | 2 | More |

| 18 USC 371 - Conspiracy to commit offense or to defraud US | 8 | 3 | 3 | 3 | More |

| 18 USC 287 - False, fictitious or fraudulent claims | 7 | 4 | 7 | 8 | More |

| 26 USC 7203 - Willful failure to file return, supply information | 6 | 5 | 6 | 9 | More |

| 18 USC 1956 - Laundering of monetary instruments | 5 | 6 | 8 | 4 | More |

| 31 USC 5324 - Structuring transactions to evade reporting requir | 5 | 6 | 12 | 15 | More |

| 18 USC 286 - Conspiracy to defraud the Government claims | 3 | 8 | 5 | 5 | More |

| 18 USC 1344 - Bank fraud | 2 | 9 | 16 | 10 | More |

| 26 USC 7202 - Willful failure to collect or pay over tax | 2 | 9 | 22 | 19 | More |

-

"Fraud and False statements" (Title 26 U.S.C Section 7206) was the most frequent recorded lead charge. This charge was also ranked first a year ago, and was the most frequently invoked 5 years ago.

-

Ranked second in frequency was the lead charge "Attempt to evade or defeat tax" under Title 26 U.S.C Section 7201. This charge was also ranked second a year ago, and was the second most frequently invoked 5 years ago.

-

Ranked third was "Conspiracy to commit offense or to defraud US" under Title 18 U.S.C Section 371. This charge was also ranked third a year ago, and was the third most frequently invoked 5 years ago.

Among these top ten lead charges, the one showing the greatest increase in prosecutions — up 166.7 percent — compared to one year ago was Title 26 U.S.C Section 7202 that involves "Willful failure to collect or pay over tax." This was the same statute that had the largest increase — 300 percent — when compared with five years ago.

Again among the top ten lead charges, the one showing the sharpest decline in prosecutions compared to one year ago — down 57.1 percent — was Conspiracy to defraud the Government claims (Title 18 U.S.C Section 286 ). This was the same statute that had the largest decrease — 66.7 percent — when compared with five years ago.

Top Ranked Judicial Districts

| Judicial District | Count | Rank | |

|---|---|---|---|

| Cal, E | 8 | 1 | More |

| Ga, N | 6 | 2 | More |

| N. Y., E | 6 | 2 | More |

| Penn, E | 6 | 2 | More |

| Cal, C | 4 | 5 | More |

| Fla, M | 4 | 5 | More |

| Ill, N | 4 | 5 | More |

| Maryland | 4 | 5 | More |

| Minnesota | 4 | 5 | More |

| N Dakota | 4 | 5 | More |

| N. Y., W | 4 | 5 | More |

| Ohio, S | 4 | 5 | More |

In April 2008 the Justice Department said the government brought 48.5 prosecutions for every ten million people in the United States.

Understandably, there is great variation in the number of prosecutions that are filed in each of the nation's ninety-four federal judicial districts.

The districts registering the largest number of prosecutions of this type last month are shown in Table 3.

-

The Eastern District of California (Sacramento) — with 8 prosecutions — was the most active during April 2008.

-

The Northern District of Georgia (Atlanta), Eastern District of New York (Brooklyn) and Eastern District of Pennsylvania (Philadelphia) ranked second with 6 prosecutions.

-

Eight districts ranked fifth with 4 prosecutions each.

Top Ranked District Judges

At any one time, there are about 680 federal District Court judges working in the United States. The judges recorded with the largest number of new crime cases of this type during April 2008 are shown in Table 4.

| Judge | Count | Rank | ||

|---|---|---|---|---|

| Burrell, Garland Ellis Jr. | Cal, E | 4 | 1 | More |

| Hovland, Daniel L. | N Dakota | 3 | 2 | More |

| Wanger, Oliver Winston | Cal, E | 2 | 3 | More |

| Middlebrooks, Donald M. | Fla, S | 2 | 3 | More |

| Story, Richard W. | Ga, N | 2 | 3 | More |

| Gillmor, Helen W. | Hawaii | 2 | 3 | More |

| Gottschall, Joan B. | Ill, N | 2 | 3 | More |

| Ericksen, Joan N. | Minnesota | 2 | 3 | More |

| Seybert, Joanna | N. Y., E | 2 | 3 | More |

| Weinstein, Jack Bertrand | N. Y., E | 2 | 3 | More |

| Arcara, Richard Joseph | N. Y., W | 2 | 3 | More |

| Skretny, William M. | N. Y., W | 2 | 3 | More |

| Dawson, Kent J. | Nevada | 2 | 3 | More |

| Rice, Walter Herbert | Ohio, S | 2 | 3 | More |

| Bartle, Harvey III | Penn, E | 2 | 3 | More |

| Surrick, R[ichard] Barclay | Penn, E | 2 | 3 | More |

| Head, Hayden Wilson Jr. | Texas, S | 2 | 3 | More |

| Biery, Samuel Frederick Jr. | Texas, W | 2 | 3 | More |

| Kimball, Dale A. | Utah | 2 | 3 | More |

| Clevert, Charles N. Jr. | Wisc, E | 2 | 3 | More |

| Crabb, Barbara Brandriff | Wisc, W | 2 | 3 | More |

Of the 21 judges who heard the most cases referred by the IRS, 13 were in districts which were listed among those with the largest number of filings, while the remaining 8 judges were from other districts.

-

Judge Garland Ellis Burrell Jr. in the Eastern District of California (Sacramento) ranked first with 4 defendants in cases.

-

Judge Daniel L. Hovland in the District of North Dakota ranked second with 3 defendants in cases.

-

A total of 19 judges tied for third with 2 defendants in cases. These included Oliver Winston Wanger in the Eastern District of California (Sacramento), Donald M. Middlebrooks in the Southern District of Florida (Miami), Richard W. Story in the Northern District of Georgia (Atlanta), Helen W. Gillmor in the District of Hawaii, Joan B. Gottschall in the Northern District of Illinois (Chicago), Joan N. Ericksen in the District of Minnesota, Joanna Seybert in the Eastern District of New York (Brooklyn) and Jack Bertrand Weinstein in the Eastern District of New York (Brooklyn).