Several Years of Record-Setting Hurricanes Lead to Deluge of Insurance Lawsuits in Louisiana Courts

Published Aug 7, 2023

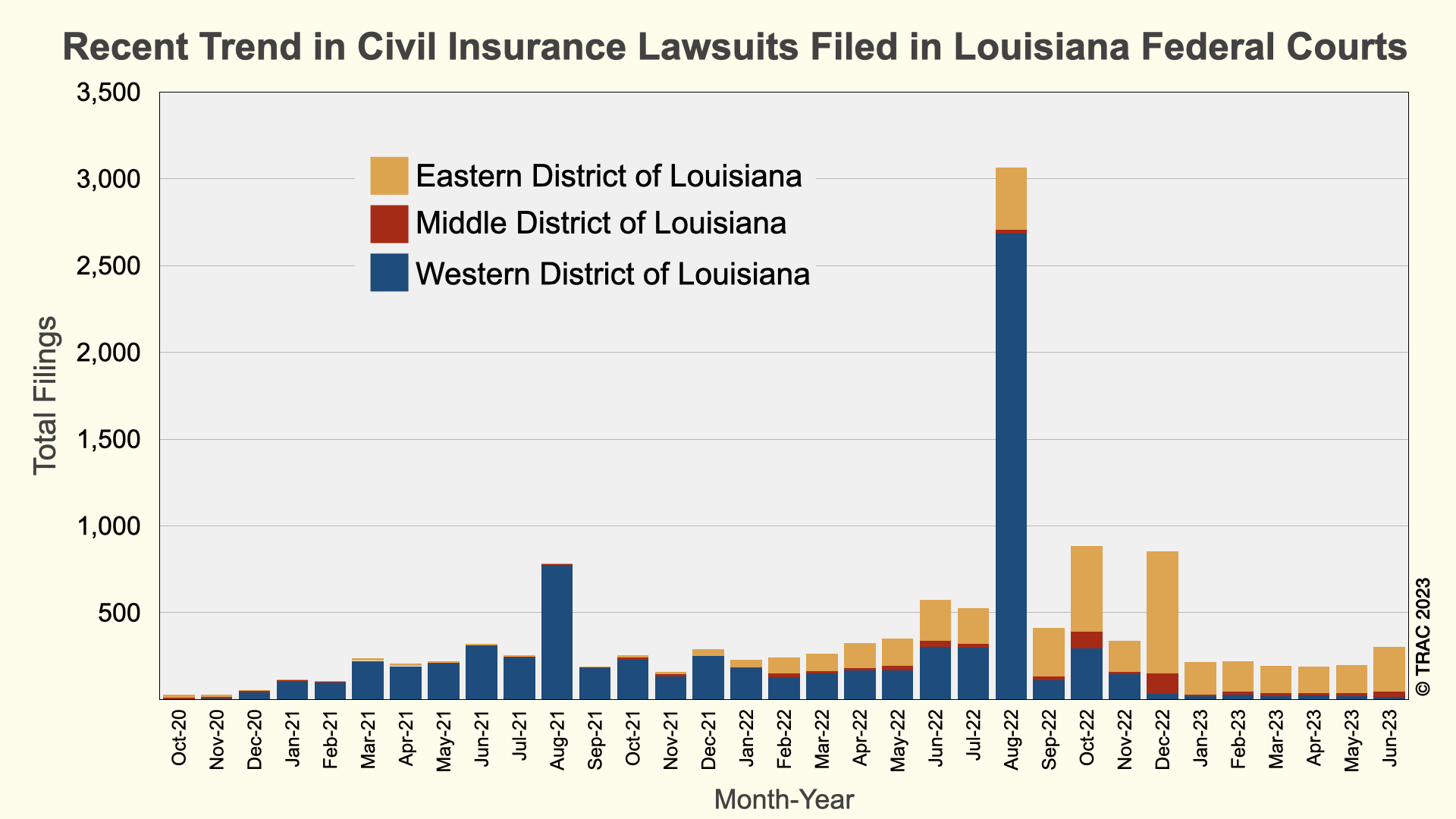

Louisiana has emerged as a hotspot for insurance-related civil litigation in federal court as repeated severe weather events undermine the region’s insurance safety nets. According to TRAC’s data on federal civil court filings, these lawsuits show a sustained increase across the state following severe weather events since FY 2020. Insurance lawsuits typically arise when residents are unsatisfied with the estimates and compensation provided by their insurance companies. So far in FY 2023, the Eastern District of Louisiana has seen the most insurance lawsuits, with 2,471 total and 255 in June alone. This is a change from FY 2021 and 2022 when the Western District of Louisiana received the largest numbers of insurance lawsuits in the state.

The timing of these lawsuits tends to be influenced by the one- and two-year filing deadlines as influenced by state law as well as other filing deadlines established by courts or other state agencies. Therefore these cases understandably arrive in court anywhere from several months to several years after the weather event itself.

For example, Hurricane Laura, one of the most severe storms to hit the state, made landfall in western Louisiana in August of 2020, leading to a spike in insurance lawsuits in the Western District of Louisiana at the one-year and two-year filing deadlines in August 2021 and August 2022. Shortly after Hurricane Laura, Hurricane Delta made landfall also in western Louisiana at the beginning of October 2020, leading to a similar, although smaller, influx of lawsuits thereafter. Hurricane Ida, on par with Hurricane Laura in magnitude and severity, made landfall in eastern Louisiana in August 2021, similarly contributing to growing lawsuits in August 2022 and, according to the Eastern District of Louisiana, likely leading to an upcoming increase in lawsuits at the next filing deadline in at the end of August 2023.

Figure 1 shows the trends in insurance lawsuit claims in federal court over the past three years in each of the three court districts in Louisiana. The additional increase in filings in December 2022 coincided with the extension by the Louisiana Insurance Guaranty Association of court filing deadlines for victims of multiple hurricanes to the end of December 2022.

These data on the high number of insurance lawsuits in Louisiana are one crucial aspect of a deeper insurance crisis in the state. In addition to the number and frequency of natural disasters, litigation has contributed to insurance companies’ reluctance to issue policies to Louisianians. Insurance companies’ business practices may also contribute to the number of insurance filings in Louisiana. For example, the State of Louisiana has taken action against a Houston based firm for allegedly filing faulty and/or fraudulent lawsuits. The state government has also sought to shore up the insurance market by passing legislation to incentivize insurance companies to stay in Louisiana, to lessen the risk for current insurers, and to attract new insurance companies to Louisiana. The high number of recent insurance filings have raised concerns about the viability of the property insurance market in Louisiana.

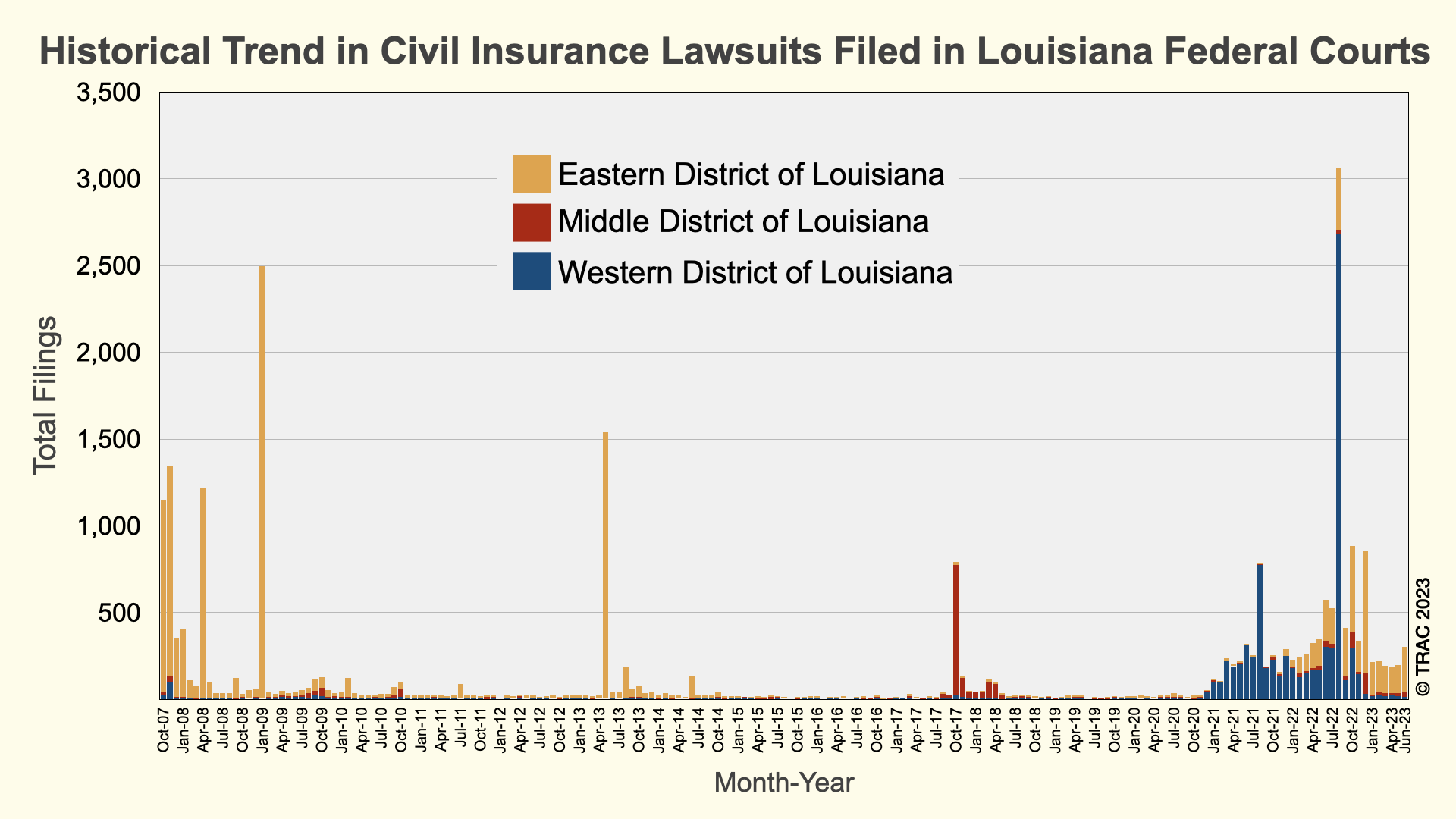

Notably, when put into historical context with similar data going back to FY 2008, the recent trend in insurance lawsuits filed monthly in Louisiana show important distinctions that may contribute to systemic challenges for the courts and for the insurance system. First, previous spikes in lawsuits tended to be associated with a single court in Louisiana. Early data from FY 2008 and 2009, as well as the spike in FY 2013, for example, show a concentration in the Eastern District Court, where New Orleans is also located, while the spike in FY 2017 was concentrated in the Middle District Court. Since FY 2021, however, all three courts have seen substantial numbers of insurance lawsuits, with the Western and Eastern Districts absorbing the most and the Middle District experience higher-than-usual numbers but smaller than the other two.

Second, although these data do not go back far enough to fully capture the consequences of Hurricane Katrina for the courts, since then, the three major spikes in insurance lawsuits that occurred in a single month tended to return to lower numbers quickly. By contrast, although the number of insurance lawsuits filed in August 2022 far outpaces any other, lawsuits have not died down, but have continued, with hundreds of new lawsuits filed every month in courts across the state. See Figure 2.

As filing deadlines and the most severe months of the 2023 hurricane season approach, these data provide context to how weather events are impacting the federal courts, the insurance system, and the people living in Louisiana. Further details can be obtained through use of our online interpreter and tracfed tools.