| Fiscal Year | IRS Employees* | |

|---|---|---|

| Total | Criminal Investigators |

|

| 2010 | 94,428 | 2,754 |

| 2011 | 91,435 | 2,731 |

| 2012 | 89,956 | 2,657 |

| 2013 | 83,666 | 2,541 |

| 2014 | 78,185 | 2,464 |

| 2015 | 76,588 | 2,319 |

| Change from 2010 to 2015 |

-17,840 | -435 |

| % Change from 2010 to 2015 |

-19% | -16% |

As Congress continues to reduce its overall support of the Internal Revenue Service (IRS), the chances that the IRS will at some point recommend a taxpayer for criminal prosecution have significantly declined — from 13.3 per million population in FY 2013 to 9.2 per million in FY 2015. This level is the lowest seen during the Obama Administration.

The reduction in the number of IRS matters referred to federal prosecutors appears to be directly related to the drop in the number of the agency's criminal investigators, which has been cut back 16 percent over the last five years (see Table 1).

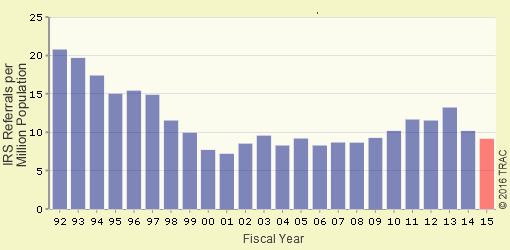

Considering the last several decades, the odds of criminal prosecution from an IRS referral, while still higher than they were during the last Bush Administration, are only half the level that prevailed twenty-five years ago in early nineties (see Figure 1).

Figure 1. IRS Referrals Sent to Federal Prosecutors Relative to District Population

Although the actual number of prosecutions brought as a result of referrals from the IRS Criminal Investigation division are miniscule (1,633 in FY 2015), they have for many years loomed large in the agency's tough-guy enforcement reputation.

These results are based upon an analysis of case-by-case Department of Justice records obtained by the Transactional Records Access Clearinghouse (TRAC) at Syracuse University through litigation under the Freedom of Information Act (FOIA).

The new criminal enforcement findings are part of a long-term effort by TRAC to monitor various aspects of the performance of this important agency. Just last week, for example, TRAC issued another report showing that Congressional budget cuts for the agency had resulted in a major reduction in the audits of the very large and largest corporations.

In that report, IRS records analyzed by TRAC show that since FY 2010 the big drop in the audits of the larger corporations — those with assets of more than $250 million dollars — appears to have resulted in a loss to the government of $15 billion a year.

District by District Details

TRAC's free IRS criminal enforcement tool allows for the exploration of the agency's criminal enforcement activities in many different ways.

For the nation as a whole, the records show that in relation to population there is a huge variation in IRS criminal recommendations in different parts of the country. Whether these variations are related to the non-compliance of the individuals living in each area, agency staffing decisions or other factors is hard to determine.

At the top was Washington, D.C. with 67 referrals or 102 per million population. Next was Alaska with 34 referrals or 47 per million. Third was the Western District of Kentucky (Louisville), with 90 criminal referrals translating to 40 per million.

At the very bottom was Wyoming, with zero referrals. Also very low was Maine with one recommendation, or one per million residents. Third from the bottom was the Southern District of Iowa (Des Moines) with three referrals, representing two per million. Ranked in between, of course, were 84 other districts.