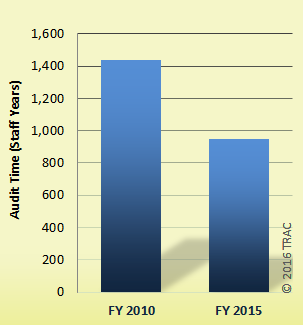

Very timely enforcement information obtained from the Internal Revenue Service show that total revenue agent audit hours aimed at larger corporations — those with $250 million or more in assets — dropped by more than one third (34%) from FY 2010 to FY 2015[1].

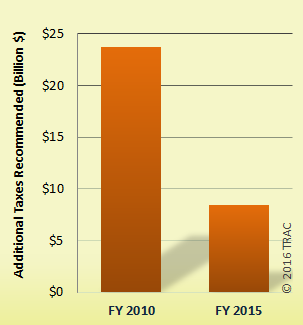

In the same period, the resulting additional taxes the agents uncovered that has been lost to the government dropped by almost two thirds (64%) — from $23.7 billion down to $8.5 billion — according to IRS data provided the Transactional Records Access Clearinghouse (TRAC) as result of several Freedom of Information Act (FOIA) lawsuits. See Figure 1.

Unless there has been a dramatic improvement in the way big corporations complied with complex requirements of the tax laws over the FY 2010 - 2015 period, this would mean that the potential loss to the government now amounts to at least $15 billion per year.

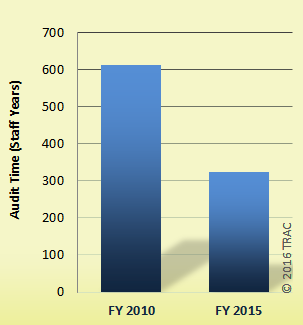

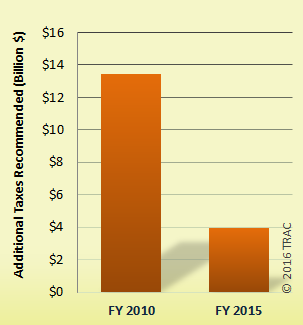

As startling as this record was for the bigger corporations, an examination focusing only on the absolute giants of the business world — those with $20 billion or more in assets — showed declines in audit attention that were even sharper. In fact, revenue agent audit time for this group in the FY 2010 - 2015 period were off by almost one half (47%) while the recommended additional taxes dropped by close to three quarters (71%). See Figure 2 and Table 1.

| Fiscal Year |

IRS Revenue Agent Staff Years** | Additional Taxes Recommended | ||

|---|---|---|---|---|

| Big Corp | Giant Corp | Big Corp | Giant Corp | |

| 2010 | 1,439 | 613 | $23,744,040,860 | $13,427,538,117 |

| 2011 | 1,300 | 478 | $23,844,838,955 | $14,197,134,146 |

| 2012 | 1,337 | 510 | $16,203,904,068 | $9,967,868,575 |

| 2013 | 1,348 | 447 | $14,810,715,689 | $8,617,548,686 |

| 2014 | 1,118 | 385 | $15,028,782,740 | $8,675,766,755 |

| 2015 | 948 | 323 | $8,450,782,665 | $3,935,256,312 |

| Change '15 vs '10 | -34% | -47% | -64% | -71% |

This analysis of the latest audit and collection performance of the IRS — an essential component of the federal government — is one in a long series of unique special reports posted to TRAC's IRS website, stretching back as far as March 1997.

While the FY 2010 - 2015 decreases are disturbing by themselves, even more recent data through February of 2016 show that the number of business audits conducted by the agency's Large Business and International (LB&I) Division is running 22 percent lower this year than for the same period last year. Monthly internal management reports show the IRS had hoped to limit the further drop to just 2 percent when they set LB&I's targets for FY 2016.

IRS had also hoped during FY 2016 to shift more attention to the audits of foreign corporations and Subchapter S corporations with assets of $10 million or more because of its concerns over tax noncompliance by these firms. LB&I targets were to increase the number of audits in these two categories by 10 percent and 20 percent, respectively. However, so far the numbers of audits are lagging below last year's pace — down 58 percent for foreign corps and down 20 percent for S corporations. See Table 2. [Comparable figures for the FY 2010 - 2015 period are found in Table 3.]

(businesses with assets $10 million or more)

FY 2015 versus FY 2016*

| Fiscal Year |

Total | Midsize Corp ($10 to $250 million) |

Big Corp ($250 million+) |

Foreign Corp | S-Corp | Partnerships |

|---|---|---|---|---|---|---|

| 2015 Target | 10,186 | 3,934 | 2,880 | 203 | 1,520 | 1,649 |

| 2016 Target | 9,937 | 3,668 | 2,817 | 223 | 1,818 | 1,411 |

| 2015 Actual (thru Feb) | 4,401 | 1,528 | 1,315 | 142 | 662 | 754 |

| 2016 Actual (thru Feb) | 3,447 | 1,223 | 1,090 | 59 | 527 | 548 |

| Change '16 vs '15: | ||||||

| Targets | -2% | -7% | -2% | 10% | 20% | -14% |

| Actual (through Feb) | -22% | -20% | -17% | -58% | -20% | -27% |

(businesses with assets $10 million or more)

FY 2010 - FY 2015

| Fiscal Year |

Total | Midsize Corp ($10 to $250 million) |

Big Corp ($250 million+) |

Foreign Corp | S-Corp | Partnerships |

|---|---|---|---|---|---|---|

| 2010 | 14,422 | 6,523 | 3,302 | 244 | 1,977 | 2,376 |

| 2011 | 15,029 | 6,635 | 3,583 | 237 | 1,996 | 2,578 |

| 2012 | 15,511 | 6,381 | 3,942 | 412 | 2,253 | 2,523 |

| 2013 | 13,911 | 4,758 | 4,593 | 363 | 1,995 | 2,202 |

| 2014 | 11,293 | 3,796 | 3,603 | 321 | 1,724 | 1,849 |

| 2015 | 10,763 | 3,759 | 3,072 | 305 | 1,786 | 1,841 |

| Change '15 vs '10 | -25% | -42% | -7% | 25% | -10% | -23% |

Congressional Cutbacks in IRS Budgets

The IRS has had to cut back its audit time because of sharp and continuing congressional reductions in its annual appropriations. These budgetary cutbacks scaled down the number of IRS employees by 19 percent during the FY 2010 - 2015 period, lessening both taxpayer service and enforcement.

Even sharper cutbacks have occurred for its revenue agents — the individuals who audit complex business returns. In September 2010, the IRS had 14,749 revenue agents. Five years later in September 2015, the agency had 4,007 fewer revenue agents — a drop of 27 percent. See Table 4.

Reduce Number of Employees

| Fiscal Year | IRS Employees* | |

|---|---|---|

| Total | Revenue Agents | |

| 2010 | 94,428 | 14,749 |

| 2011 | 91,435 | 13,904 |

| 2012 | 89,956 | 13,072 |

| 2013 | 83,666 | 12,290 |

| 2014 | 78,185 | 11,503 |

| 2015 | 76,588 | 10,742 |

| # Change '15 vs '10 | -17,840 | -4,007 |

| % Change '15 vs '10 | -19% | -27% |

In an April statement to the Tax Policy Center, a non-partisan group associated with the Urban Institute and the Brookings Institution, IRS Commissioner John A. Koskinen criticized the continuing Congressional reductions in IRS audit and collection employees. In FY 2015 alone, he said, it will translate "into a loss for the government of at least $2 billion in revenue that otherwise would have been collected."

Koskinen further estimated the cuts meant a seven to eight billion dollar loss since FY 2010. "As some have called it," he told the gathered tax experts, the IRS staff reductions mandated by Congress "amounts to a tax cut for tax cheats."

The intense worry about the crumbling tax structure, however, was not limited to the current head of the agency. A few months ago, seven former commissioners[2] who had held the position under presidents Kennedy Johnson, Reagan, Bush, Clinton, and Bush wrote a joint letter to the House and Senate appropriations committees. "Over the last fifty years, none of us has ever witnessed anything like what has happened to the IRS appropriations over the last five years and the impact these appropriations reductions are having on our tax system," the seven said.

As noted above, the slashing of the agency's budget and the resulting declines in enforcement activities is not a one-year aberration. And in fact, the IRS Commissioner said that the IRS is now at its lowest funding level since FY 2008. But, he added, when expressed in inflation adjusted terms, the budget is actually comparable to the agency's situation in 1998.

The budget cuts have continued and the number of taxpayers has grown even while the Congress has ordered the agency to handle broad new responsibilities such as the tax-related provisions of the Affordable Care Act and the implementation of the Foreign Account Compliance Act.

Curiously, the last few years of successful attacks in Congress on the levels of IRS funding, and its sharply declining enforcement efforts, come at a time when there is a growing political concern about the expanding political powers wielded by the largest corporations and their effects on the workings of the economy. This worry about the power of corporations — expressed by political figures such as Senator Bernard Sanders (D-VT) and Senator Elizabeth Warren (D-MA) — has been paralleled with concerns about the increasing concentration of wealth in fewer and fewer hands.

Footnotes

[1] Today, the IRS spends less and less time on average for an audit of these big companies. However, for large corporations, it isn't so much whether they are audited but how thorough an audit is conducted. While the number of audits of big companies fell by only 7 percent (see Table 3 above), the time spent examining these company accounts dropped 34 percent.

[2] The November 9, 2015 letter's signatories were former IRS Commissioners Mortimer M. Caplin (1961-1964), Sheldon S. Cohen (1965-1969), Lawrence B. Gibbs (1986-1989), Fred T. Goldberg Jr. (1989-1992), Shirley D. Peterson (1992-1993), Margaret M. Richardson (1993-1997), and Charles O. Rossotti (1997-2002) (Tax Notes, "Former IRS Commissioners Call for Bigger IRS Budget," November 16, 2015).