Securities and Commodities Exchange Litigation Reaches New High In March 2021

The latest available data from the federal courts show that during March 2021, the government reported 269 new securities and commodities exchange civil filings based upon the recorded nature of the suit. According to the case-by-case court records analyzed by the Transactional Records Access Clearinghouse (TRAC) at Syracuse University, this is the highest number of such filings for a single month on record going back to at least October 2007 and just edging out the previous high of 262 in September 2020. This new high in cases reflects ongoing growth in these types of cases as TRAC observed in reports from 2020[1] and 2017[2].

Suits in this category involve alleged violations of the Securities and Exchange Act (15 USC 78), securities fraud under 15 USC 77 and 12 USC 22, violations of commodities exchange regulations and other breaches of fiduciary duties.

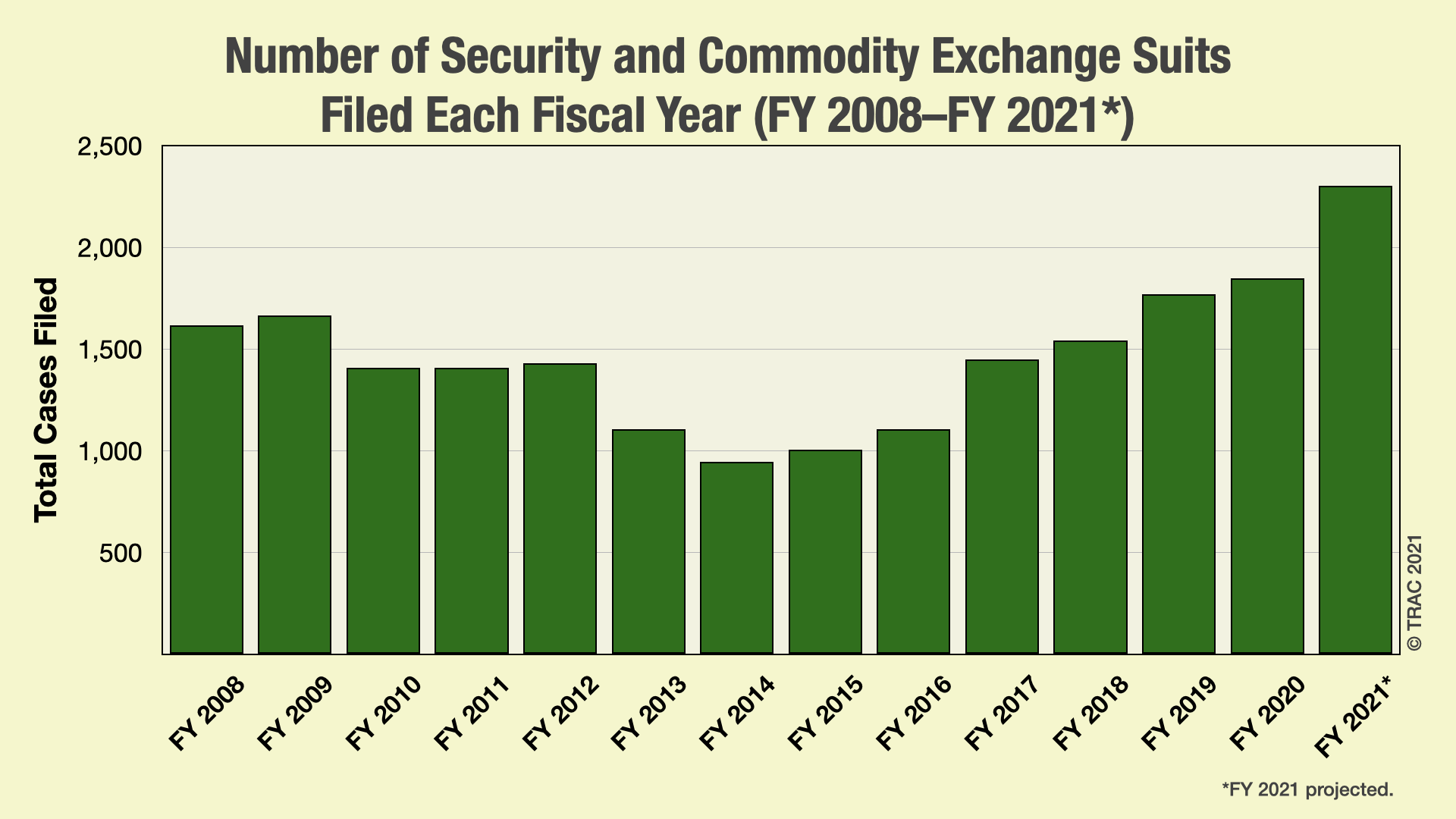

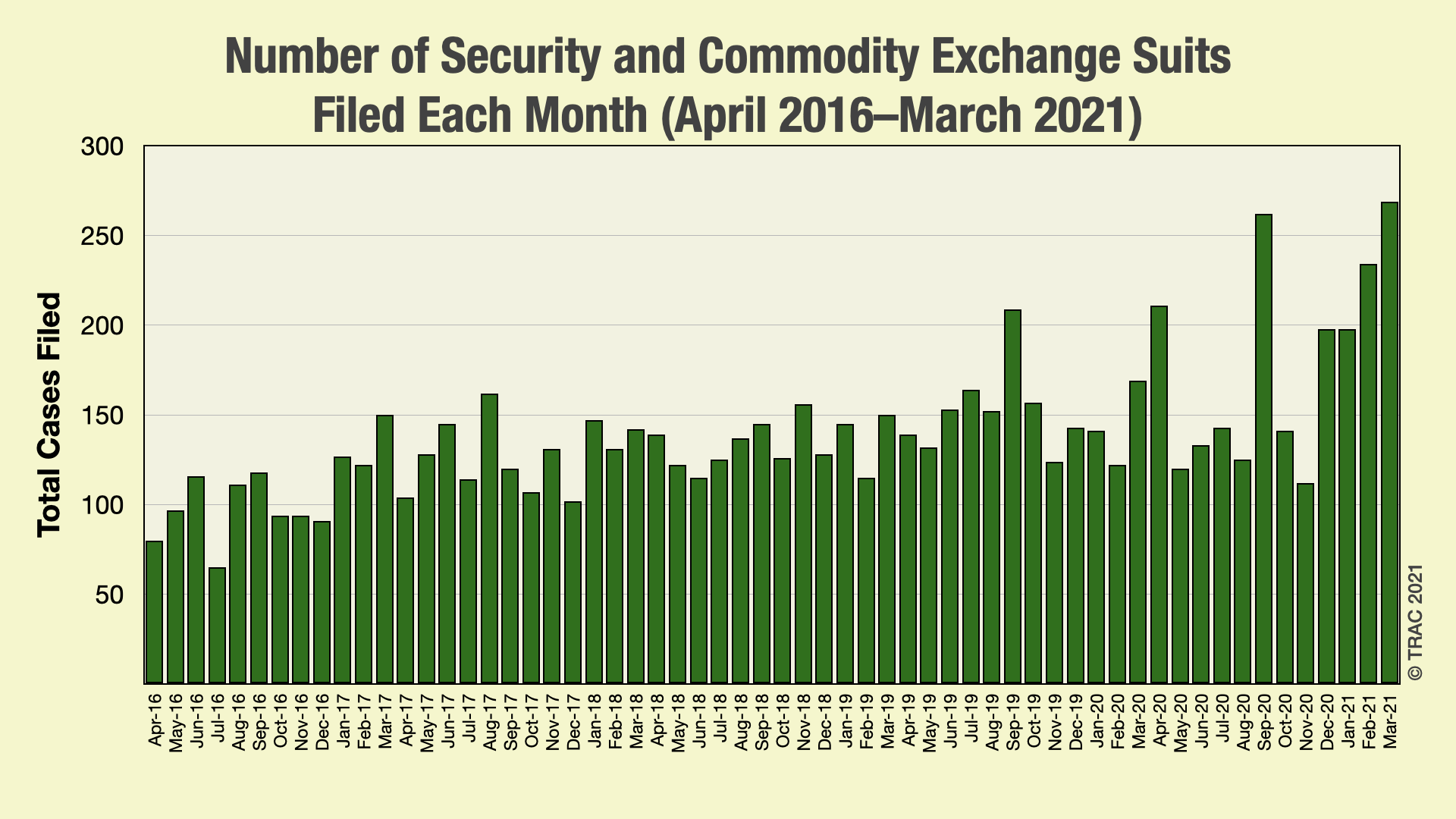

This brings the total of securities and commodities exchange civil filings to a total of 1,152 in the first six months of fiscal year 2021. The average number of filings per month so far this fiscal year is 192, up from 154 per month in fiscal year 2020, suggesting that 2021 is on pace to be the busiest year for securities and commodities exchange cases. See Figure 1 for the number of securities and commodities exchange case filings each year since FY 2008. The figure for FY 2021 is a projection based on an average of the first six months of the fiscal year. Figure 2 shows the number of filings each month for the past five years.

FY 2008-FY 2021 (projected).(Click for larger image)

April 2016 to March 2021.(Click for larger image)

Top Ranked Judicial Districts

Suits of this type tended to be concentrated in just a few federal judicial districts. Nearly half were filed in just two district courts. More than one third—99 total—of the securities and commodities exchange suits brought in March 2021 were filed in just the Southern District of New York (Manhattan). This was followed by Delaware with 12 percent of the cases. See Table 1 for a list of cases by district. Districts not listed had no filings recorded in March 2021.

| Federal District | Total Filings | Percent of Total |

| N. Y., S | 99 | 36.8% |

| Delaware | 32 | 11.9% |

| N. Y., E | 16 | 5.9% |

| Penn, E | 16 | 5.9% |

| Cal, C | 15 | 5.6% |

| Cal, N | 13 | 4.8% |

| Fla, S | 12 | 4.5% |

| N. J. | 12 | 4.5% |

| Colorado | 7 | 2.6% |

| Cal, S | 4 | 1.5% |

| Ill, N | 3 | 1.1% |

| Maryland | 3 | 1.1% |

| N. Y., W | 3 | 1.1% |

| Wisc, E | 3 | 1.1% |

| Conn | 2 | <1% |

| Idaho | 2 | <1% |

| Ind, S | 2 | <1% |

| Mich, E | 2 | <1% |

| Nevada | 2 | <1% |

| Ohio, N | 2 | <1% |

| Ohio, S | 2 | <1% |

| Penn, W | 2 | <1% |

| Utah | 2 | <1% |

| Wash, W | 2 | <1% |

| Arizona | 1 | <1% |

| D. C. | 1 | <1% |

| Fla, N | 1 | <1% |

| Ken, E | 1 | <1% |

| Mass | 1 | <1% |

| Mo, W | 1 | <1% |

| New Hamp | 1 | <1% |

| Texas, S | 1 | <1% |

| Texas, W | 1 | <1% |

| Virg, E | 1 | <1% |

| Wash, E | 1 | <1% |

| Total | 269 | 100.0% |

Footnotes

[1] See "Securities and Commodities Exchange Litigation Reaches All-Time High in September 2020" published in 2020. https://trac.syr.edu/tracreports/civil/632/.

[2] See "Securities and Commodities Exchange Litigation Up 37 Percent" published in 2017. https://trac.syr.edu/tracreports/civil/473/.