Stockholder Lawsuits Down 40 Percent in Last Four Years

The latest available data from the federal courts show that in the last 12 months ending in June 2016 the federal government reported 259 new stockholder civil lawsuits filed. According to the case-by-case government records analyzed by the Transactional Records Access Clearinghouse (TRAC) at Syracuse University, this number is about the same as during the previous 12-month period ending in June 2015. However, both of the past two years are down by more than a third (35.4%) from five years ago when the number of civil filings of this type totaled 401.

The comparisons of the number of civil filings for stockholder suits are based on case-by-case federal court records which were compiled and analyzed by TRAC (see Table 1).

| 12 Months Ending In: | Filings |

|---|---|

| Current Year (June 2016) | 259 |

| Last Year (June 2015) | 253 |

| 5 Years Ago (June 2011) | 401 |

| Peak (May 2012) | 437 |

| Percent Change vs. | |

| Last Year | 2.40% |

| 5 Years Ago | -35.40% |

| Peak | -40.70% |

Stockholder lawsuits over such matters as alleged securities violations, breach of contract, breach of fiduciary duties or disputes over accounts receivable frequently end up in federal court because of the "diversity of citizenship" of the parties. That is, the parties involve citizens of different states, or from one or more states and a foreign party. Suits can also involve a "federal question" under, for example, the federal Securities and Exchange Act, the Investment Company Act of 1940, along with various federal fraud and racketeering statutes.

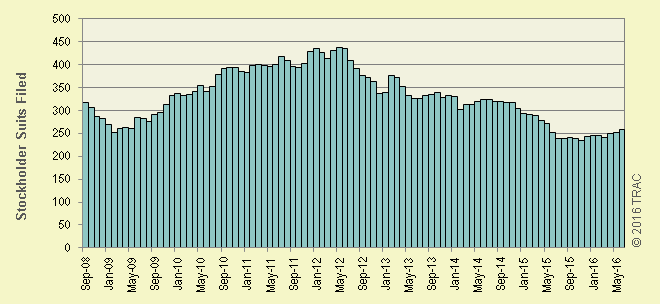

The long term trend in federal stockholder lawsuits going back to 2008 can be seen more clearly in Figure 1. The vertical bars in Figure 1 represent the number of filings of this type recorded for each 12-month period ending in the month shown plotted. The 12-month running totals climbed to a peak of 437 in May of 2012 before starting their descent. Compared to their peak, stockholder suits in the 12 months ending June 2016 had fallen by 40.7 percent.

Figure 1. Stockholder Lawsuits Filed (12 month moving totals)

District Comparisons

Delaware led the nation in having the most stockholder suits filed relative to its population - a whopping 17 times the rate that occurred nationally. The national average was 0.8 per million, while that state saw a total of 13 stockholder suits, or 13.7 per million population.

Focusing on the sheer number of suits filed, the Southern District of New York (Manhattan) with 25 lawsuits filed during the last 12 months had the most. Relative to its population, it had six times the national average and ranked in second place on this basis. (The Northern District of California was a close second in sheer numbers with 21 stockholder suits filed.)

Nevada relative to its population had 4.2 suits per million population or over five times the national average. That state saw 12 stockholder suits filed during the last 12 months.

Table 2 provides the other federal districts in the top ten, along with their number and per capita rate of stockholder lawsuits. These districts are: Vermont (4), Southern District of California (5), Northern District of California (6), Eastern District of Arkansas (7), Eastern District of Michigan (8), Southern District of Florida (9) and Connecticut (10).

| District | Number | Per Capita* | Rank Per Capita |

|---|---|---|---|

| Delaware | 13 | 13.7 | 1 |

| N. Y., S | 25 | 4.8 | 2 |

| Nevada | 12 | 4.2 | 3 |

| Vermont | 2 | 3.2 | 4 |

| Cal, S | 11 | 3.2 | 5 |

| Cal, N | 21 | 2.5 | 6 |

| Ark, E | 3 | 1.8 | 7 |

| Mich, E | 11 | 1.7 | 8 |

| Fla, S | 11 | 1.5 | 9 |

| Conn | 5 | 1.4 | 10 |

Each month, TRAC offers a free report focused on one area of civil litigation in the U.S. district courts. In addition, subscribers to the TRACFed data service can generate custom reports by district, office, nature of suit or federal jurisdiction via the TRAC Data Interpreter.