IRS Audits Poorest Families at Five Times the Rate for Everyone Else

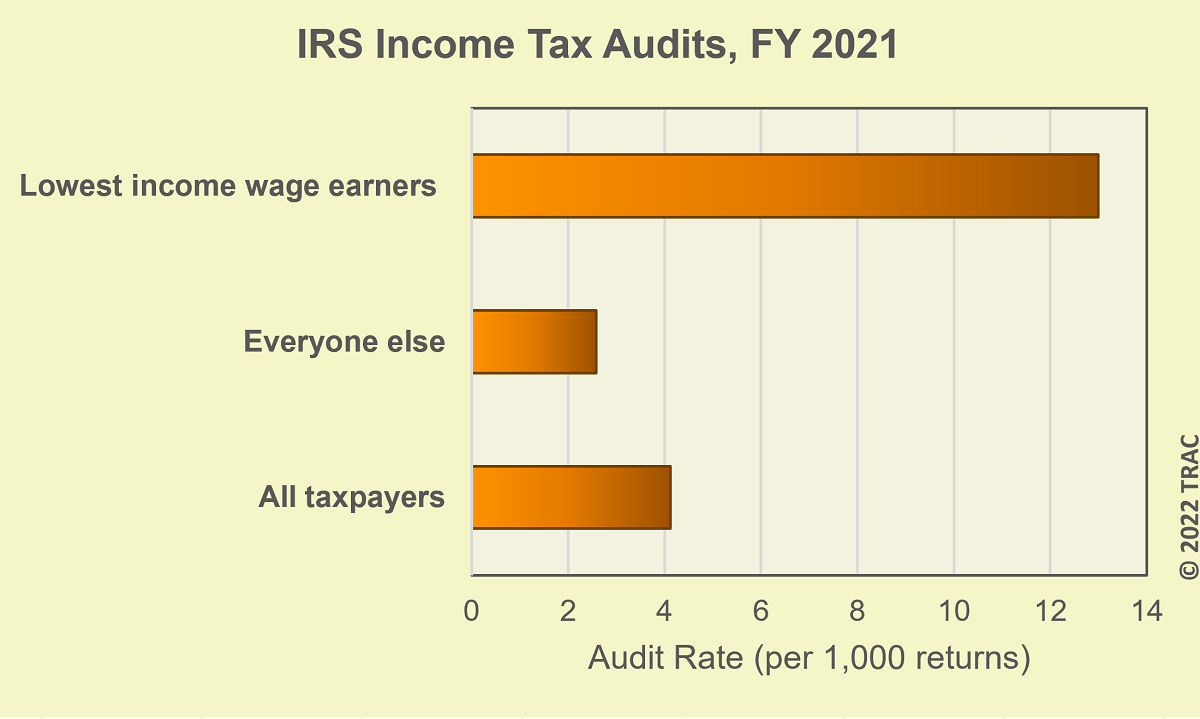

A large increase in federal income tax audits targeting the poorest wage earners allowed the Internal Revenue Service to keep overall audit numbers from further declines for Americans as a whole during FY 2021. That resulted in these low-income wage earners with less than $25,000 in total gross receipts being audited at a rate five times higher than for everyone else.

(Click for larger image)

| Category of Taxpayer | Returns Filed | IRS Audits | Rate (per 1000) |

| Lowest income wage earners* | 23,620,209 | 306,944 | 13.0 |

| Everyone else | 136,457,242 | 352,059 | 2.6 |

| All taxpayers | 160,077,451 | 659,003 | 4.1 |

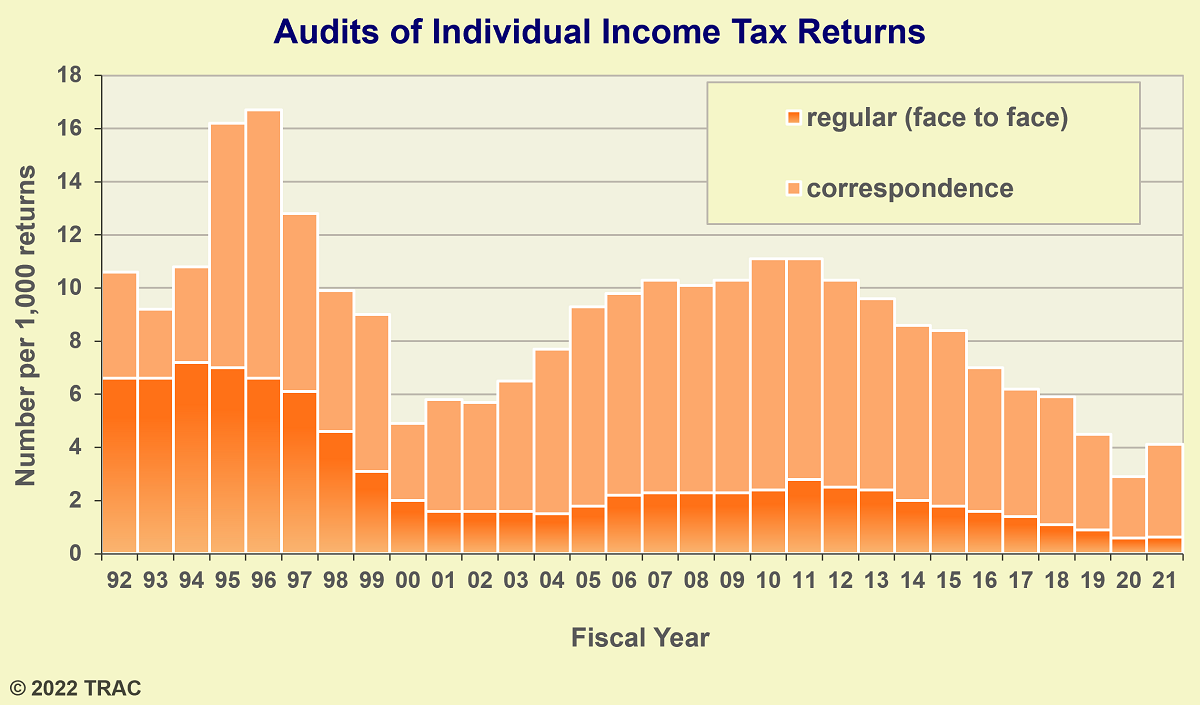

Last year out of over 160 million individual income tax returns that were filed, the IRS audited 659,003 – or just 4 out of every 1,000 returns filed (0.4%). This was only slightly lower than the overall odds of audit from FY 2019, and above FY 2020 levels where just 3 out of every 1,000 returns filed were examined[1]. Audit rates in general have been dropping for many years. See Figure 2.

These results are based on internal IRS reports released each month to the Transactional Records Access Clearinghouse (TRAC) at Syracuse University under a court order entered after successful litigation under the Freedom of Information Act.

IRS accomplished over 650 thousand audits last year by jacking up its already high reliance on so called “correspondence audits” – essentially a letter from the IRS asking for documentation on a specific line item on a return. All but 100,000 of the 659,000 audits were conducted with these letters through the mail. Correspondence audits during FY 2021 rose to 85% of all IRS tax audits -- up from roughly 80 percent during the previous two years. See Table 2.

| FY 2019 | FY 2020 | FY 2021 | |

| All audits | 680,543 | 452,515 | 659,003 |

| Returns filed | 152,624,939 | 153,625,492 | 160,077,451 |

| Rate (per 1,000 returns) | 4.5 | 2.9 | 4.1 |

| Type of IRS Audit | |||

| Correspondence audits | 547,111 | 359,720 | 559,420 |

| Regular (face-to-face) audits | 133,432 | 92,795 | 99,583 |

| Percent correspondence | 80.4% | 79.5% | 84.9% |

However, over half of these correspondence audits were targeted at the small proportion of workers with incomes so low they had claimed an anti-poverty earned tax credit to offset the tax otherwise due on their modest earned income. To repeat: over half – fully 54 percent – of all correspondence audits last year targeted the small proportion of returns with gross receipts of less than $25,000 claiming an earned income tax credit.

Even taxpayers with total positive income from $200,000 to $1,000,000 had only one- third the odds of audit compared with these lowest income wage earners. A total of nearly 9 million taxpayers reported these high-income levels. Yet less than 40 thousand of their returns were audited by the IRS in FY 2021 – just 4.5 out of every 1,000 of these returns[2]. This contrasts sharply with 13.0 out of every 1,000 of these lowest income returns that were audited last year by the IRS.

Does it make sense from either an equity or revenue standpoint to focus IRS’s limited firepower on the poorest taxpayers among us – those with incomes so low they have filed returns claiming an anti-poverty earned income tax credit? This question alone raises profound issues.

Most current estimates identify high-income taxpayers with complex investments as well as taxpayers with large, complicated business transactions as those where the gap between taxes owed and taxes reported and paid are actually concentrated[3].

In addition, the basic unfairness of targeting those among us with the lowest levels of income is made profoundly worse by the way IRS conducted these audits as discussed below.

The Crisis Caused by Inadequate Staffing at the IRS

Many problems plagued the IRS and tax administration last year. Erin M. Collins, the National Taxpayer Advocate, in her annual report to Congress noted:

“There is no way to sugarcoat the year 2021 in tax administration. From the perspective of tens of millions of taxpayers, tax administration did not work for them.”

The source of the problem: years of starving the IRS for resources so that there were simply too few people to adequately staff the agency. This was compounded because during the pandemic, Congress had assigned the IRS more and more vital responsibilities.

In her latest annual report to Congress, National Taxpayer Advocate Collins went on to describe the significant challenges taxpayers faced. She explained:

“Taxpayers require basic support and guidance from the IRS to fulfill their filing obligations and pay amounts legally due. Phone service is an essential component of support and guidance, providing assistance to tens of millions of taxpayers every year. In most years, taxpayers have difficulty reaching IRS customer service representatives (CSRs) to obtain tax assistance and account information, but this past year was worse than usual, as call volume nearly tripled and only 11 percent of calls reached a CSR. … Without support, taxpayers are disadvantaged and frustrated, and tax compliance is jeopardized.”

How IRS Conducts Audits of Low-Income Taxpayers is Fundamentally Unfair

Among these problems, Collins singled out the basic unfairness low-income taxpayers faced with the complex issues inherently involved with the anti-poverty earned income tax credit. The National Advocate noted:

“The IRS correspondence audit process is structured to expend the least amount of resources to conduct the largest number of examinations – resulting in the lowest level of customer service to taxpayers having the greatest need for assistance.”

Collins faulted IRS for assuming: (1) that these particular correspondence audits were simple. The requirements to substantiate earned income tax credits weren’t simple for this taxpayer segment, but often very complex. (2) IRS was faulted for not providing “comprehensible IRS correspondence” when sending these audit letters. Such letters can be only charitably described as often written in “computer-speak” jargon which fails to make much sense. (3) She further faulted the IRS for only providing these individuals with a generic toll-free telephone number which historically had been inadequately staffed, and reached a new low last year when the public could rarely get through to speak with anyone.

The unfortunate situation faced today by this lowest income segment of taxpayers is not new. History is just repeating itself. More than twenty years ago, TRAC similarly reported that “low income taxpayers now stand a greater chance of being audited than higher income taxpayers.” Precisely the same rationale occurred back then: a jump in correspondence audits of low-income taxpayers reporting an earned income tax credit[4], and cutbacks in IRS staff. Quoting directly from TRAC’s report back in 2000:

“Two developments have contributed to the dramatic shift in audit targets from the relatively rich to the relatively poor. One was the congressional mandate that the IRS reduce non-compliance in the Earned Income Credit program, a special tax benefit for low-income Americans[5].

A second factor has been the substantial decline in the size of the IRS during the Bush and Clinton administrations. There were 31% fewer full- time IRS employees at the end of 1999 than in 1988. … With fewer IRS employees, the face-to-face district audits essential for the examination of larger and more complex returns have steadily slumped. In 1981, for example, the rate for these more intense kind of audits was five times higher than in 1999.”

Few Millionaires Are Audited

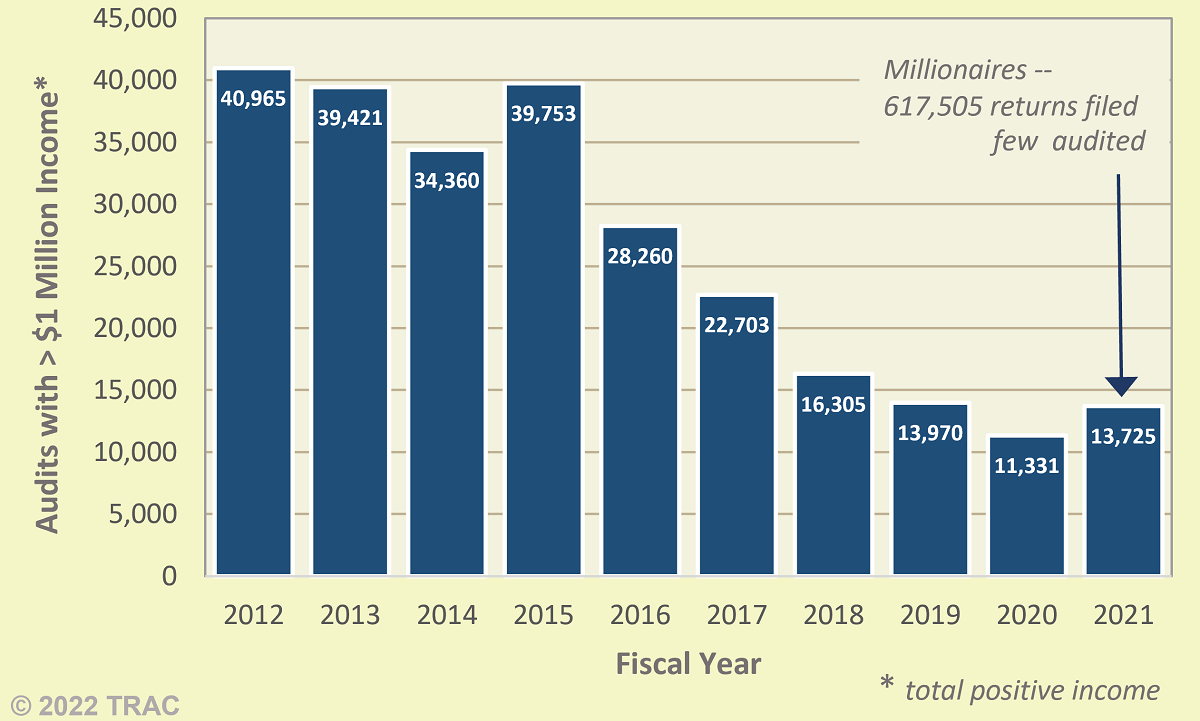

To its credit last year, the IRS did manage to slightly raise the audits of millionaires. During FY 2021 IRS revenue agents and tax examiners audited 13,725 of taxpayers reporting $1 million dollars or more in positive income. This was up from the abysmally small numbers audited during FY 2020 (11,331), but still slightly below how many millionaire returns were audited during FY 2019 (13,970).

Despite this modest improvement, IRS was still only managing to conduct about a third of the millionaire audits it had completed during FY 2015. Then IRS had audited 39,753 millionaire returns.

Over this same short span of time, the odds of audit fell even more because the sheer number of millionaire returns has grown by 50 percent. Thus, the odds of audit have been plummeting. IRS recorded 617,505 millionaire returns filed that were available to be audited in FY 2021. With only 13,725 millionaire audits last year, more than 600,000 millionaire returns were NOT audited. See Figure 3.

(Click for larger image)

High-Income Returns Escape Audit Because IRS Not Hiring Enough Revenue Agents

A critical limitation in the IRS’s ability to audit millionaires is the availability of IRS revenue agents. Only this class of auditors, given sufficient training and experience, are qualified to examine complex tax returns – the types of returns typically filed by high-income individuals and large-scale businesses.

With severe budget constraints, IRS has tended to trade off the replacement of revenue agents with hiring more tax examiners. These certainly are paid less, but they are also less knowledgeable. While revenue agents used to outnumber tax examiners, this has slowly shifted over time.

Since the end of FY 2010, the number of IRS revenue agents has dropped by 41 percent. Initially, the number of tax examiners also fell although not at the same rate. By FY 2016, tax examiners began to outnumber revenue agents for the first time. During FY 2020 and FY 2021, major increases took place in the hiring of tax examiners. Thus, the number of tax examiners has regained all of their lost ground and were actually 1 percent higher than in 2010. See Figure 4 and Table 3.

| Fiscal Year* | Revenue Agents | Tax Examiners |

| 2010 | 14,749 | 12,209 |

| 2011 | 13,904 | 11,843 |

| 2012 | 13,072 | 11,805 |

| 2013 | 12,290 | 11,495 |

| 2014 | 11,503 | 10,933 |

| 2015 | 10,742 | 10,435 |

| 2016 | 10,400 | 10,486 |

| 2017 | 9,605 | 9,853 |

| 2018 | 8,944 | 10,248 |

| 2019 | 8,793 | 10,205 |

| 2020 | 8,350 | 12,441 |

| 2021 | 8,642 | 12,334 |

| FY 2010 vs 2021 | -41% | 1% |

This changing mix of IRS audit staff has had a profound impact on both which types of returns get audited, as well as the depth of these audits. The scales have tilted towards IRS targeting less complex issues and returns, and conducting less in-depth audits. While examiners may be cheaper to hire in the short run, the unavailability of experienced revenue agents means that complex tax returns often go unexamined, while complicated tax issues if reviewed at all are not audited in as much depth. Yet these are the targets where experts believe the largest amount of tax revenue is escaping detection and collection.

Conclusion

As budget cuts have forced a reduction in many different IRS efforts, how will these steady declines affect the continuing viability of the nation’s voluntary federal income tax system? Only a small proportion of tax returns and transactions having tax consequences are ever examined. And that proportion has been steadily dropping year after year.

Compliance with tax requirements, especially for those with income not subject to automatic tax withholding, rests in no small part on the public’s belief that they should comply. How long with this belief continue when IRS targets low-income taxpayers because they are simply easier to audit while those with higher incomes escape any examination?

Footnotes

[1] These rates are based on the number of audits relative to the number of returns filed in the previous calendar year. Because IRS audits can include returns filed in previous years, this rate is an approximation. However, it permits consistent year-to-year comparison.

[2] Only 39,449 of the 8,775,144 returns reporting between $200,000 and $1 million dollars of total positive income were audited by the IRS during FY 2021. For IRS audits of those with incomes about $1 million, see Figure 3 above.

[3] According to the Department of the Treasury, “the gross tax gap – the difference between taxes paid and taxes owed -- … is expected to rise to about $7 trillion by 2029 if left unaddressed.” “While roughly 99% of taxes due on wages are paid to the Internal Revenue Service (IRS), compliance on less visible sources of income is estimated to be just 45%. The tax gap disproportionately benefits high earners who accrue more of their income from non-labor sources where misreporting is common.” See also, “Tax Evasion at the Top of the Income Distribution: Theory and Evidence,” National Bureau of Economic Research Working Paper 28542, March 2021 and “Tax cheats cost the U.S. $1 trillion per year, I.R.S. chief says,” New York Times, April 13, 2021.

[4] Correspondence audits (called “Service Center” audits back then) jumped from 387,533 in FY 1998 to 524,050 in FY 1999 for this low-income group.

[5] Of course, the actual average taxes and penalties IRS auditors recommended was actually lowest on these low- income returns and rose substantially for middle and high-income tax taxpayers. That year, the average under- reporting of tax was found by auditors to be $14,785 for returns with total positive income of $100,000 or more (then the highest income bracket) while just $2,404 on these low-income wage-earners with less than $25,000 in total positive income. And, back then, as now the problem was often not that these low-income taxpayers actually weren’t entitled to the credit. They just weren’t given the tools or assistance needed to meaningfully respond to these IRS computer notices. Source: https://tracfed.syr.edu > administrative enforcement > IRS.