Nearly Half of Corporate Giants Escape IRS Audit in 2017

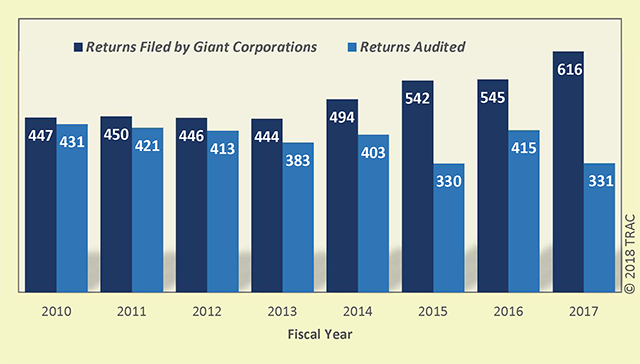

The Internal Revenue Service (IRS) reports that nationally there are now 616 corporate giants. These are companies that reported $20 billion or more in assets. The number of these mammoth companies has grown by more than a third (38%) over the past seven years.

However, the number of IRS audits of these giants has not grown. Instead, audits have been falling. During FY 2017 IRS audited only 331 of these corporate giants down from 431 audits in FY 2010.

These two opposite trends - more returns, yet fewer audits - meant that the odds these corporate giants received an IRS audit fell dramatically. As recently as FY 2010 virtually every (96%) corporate giant received an IRS audit. By FY 2016, this had fallen to only three out of four (76%). And last year, during FY 2017, the audit rate tumbled to a mere two out of every four - or roughly half (54%). This means that nearly half of these corporate behemoths escaped any IRS audit.

Table 1. IRS Audits of Corporate Giants

in FY 2017*

in FY 2017*

| Fiscal Year | Returns Filed | Audits | Audit Time |

|---|---|---|---|

| 2010 | 447 | 431 | 613 |

| 2011 | 450 | 421 | 478 |

| 2012 | 446 | 413 | 510 |

| 2013 | 444 | 383 | 447 |

| 2014 | 494 | 403 | 385 |

| 2015 | 542 | 330 | 323 |

| 2016 | 545 | 415 | 418 |

| 2017 | 616 | 331 | 311 |

| Change '17 vs '10 | 38% | -23% | -49% |

Furthermore, when the IRS did conduct audits of these companies, their thoroughness also has fallen. Indeed, despite the fact that there were more of these very complex returns filed by these gigantic companies, the total audit time devoted to these companies fell by almost half (down 49%). See Table 1.

Revenue Implications

What are the revenue implications of allowing these 285 corporate giants to escape an audit? Some inkling of the magnitude of lost revenue to the federal coffers is suggested by the sizable amount of unreported taxes turned up in the 331 audits that were conducted of these largest firms. In total, these few hundred audits resulted in uncovering $10.4 billion in federal taxes that had not been reported.

Indeed, the audit of just one of these giant firms on average turned up $31.6 million in recommended additional taxes owed by that company. Because agents now spend the combined time of less than a year auditing even these largest firms, the work on average of just one IRS revenue agent was responsible for finding $33.6 million in unreported taxes. This compares with his or her annual average pay last year of just $106,696. See Table 2.

Table 2. Recommended Additional Taxes from Audits of Corporate Giants

in FY 2017

in FY 2017

| Total Additional Taxes | $10,444,397,711 |

| Average per Audit | $31,554,072 |

| Average per Revenue Agent | $33,566,759 |

| Average Revenue Agent Salary | $106,696 |

As detailed in Table 3, the total additional recommended taxes IRS auditors uncovered in just the few hundred audits of corporate giants turned up more dollars than in all of the remaining corporate audits - of any size - that it conducted last year. In fact, these 331 audits last year uncovered much more tax under-reporting ($10.4 billion) than was turned up in the combined 933,785 audits of tax returns filed by all individuals ($9.0 billion). To borrow from Willie Sutton's apocryphal rejoinder, clearly if the federal government is interested in uncovering underreporting of federal income taxes it should focus on the returns of corporate giants because that is where the money is.

Table 3. Recommended Additional Taxes by Audit Class in FY 2017

| Returns Filed by: | Returns Audited | Additional Tax |

|---|---|---|

| Individuals | 933,785 | $9.0 billion |

| Corporations* | ||

| Small and midsize | 15,099 | $0.9 billion |

| Big (excluding giants) | 2,014 | $5.6 billion |

| Giant | 331 | $10.4 billion |

Why Aren't More Corporate Giants Audited?

So why did nearly half of these mammoth firms escape being audited?

The main reason was the lack of available staff. Congressional cutbacks to IRS's budget have severely trimmed the ranks of available IRS revenue agents - the auditors who examine corporate and high income individual returns. Last year, there were 5,144 fewer IRS revenue agents employed than there had been in FY 2010. Over the past seven years, revenue agents have fallen by over a third (34.9%). Fewer auditors mean that fewer audits can be conducted.

There are also many worthy competing demands for revenue agents' time. Over the years, Congress has heaped additional duties on the IRS even while trimming its resources. In response, IRS managers have had to decide which areas to cut, and by how much. The end result is that in allocating the diminished number of revenue agents, these corporate giants have taken larger relative cuts. In fact, as mentioned earlier, the number of revenue agent staff years assigned to examine these corporate giants has fallen by half (49.2%) - considerably more than the drop over the same period of time in total revenue agents on IRS payrolls. Compare Tables 1 and 4.

Table 4. Revenue Agents on IRS Payroll

| Fiscal Year | Number |

|---|---|

| 2010 | 14,749 |

| 2011 | 13,904 |

| 2012 | 13,072 |

| 2013 | 12,290 |

| 2014 | 11,503 |

| 2015 | 10,742 |

| 2016 | 10,400 |

| 2017 | 9,605 |

| Change '17 vs '10 | -35% |

Conclusion

The plummeting scrutiny given by IRS to the returns of corporate giants is just one of many indicators of the sorry state of affairs Congress has created by imposing years of severe funding and staffing cuts on the agency. Further, at the close of 2017, Congress enacted sweeping changes to the tax laws. Passage of the Tax Cuts and Jobs Act (TCJA) was signed by the President on December 22, 2017.

The responsibilities for implementing this new legislation impose many new demands on the agency. Without adequate resources to meet already existing needs, IRS's efforts to meet these new demands can only exacerbate existing problems. The prognosis for the future and for the health of our federal income tax system appears hardly reassuring.