|

|

In the aftermath of the financial crisis, the federal government launched several high-profile initiatives to crack down on financial fraud in the banking and mortgage industries. So why havenít we seen more criminal prosecutions in these areas?

The Transactional Records Access Clearinghouse (TRAC) recently reported that federal criminal prosecutions for financial institution fraud are at a 20-year low. This grim news comes at a time when everyone from Wall Street protestors to federal judges is questioning the governmentís enforcement efforts.

TRACís report specifically examined federal criminal prosecutions for Financial Institution Fraud, described as ď[f]raud and embezzlement, including through the use of credit cards and credit card information, in which banks, savings and loan associations, credit unions and similar financial institutions are the victims.Ē In FY 2010, the vast majority of these prosecutions resulted from referrals by one of three agencies: the FBI, Postal Service, and Secret Service.

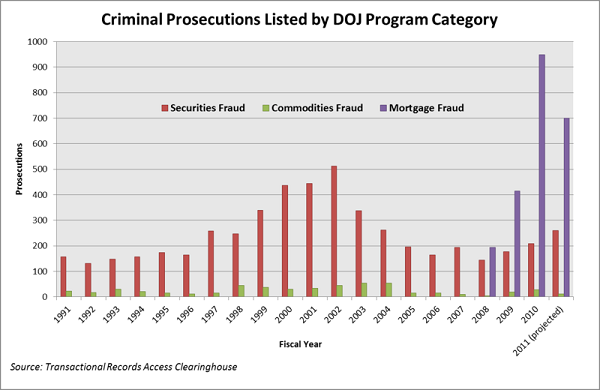

To be fair, there has been a modest increase in criminal prosecutions under other DOJ categories such as Mortgage and Securities Fraud.

For more on this issue, be sure to check out TRACís report, which also includes the latest monthly data on the top ranked lead charges, judicial districts, and district judges for cases involving financial institution fraud.

|

|

|

|