|

|

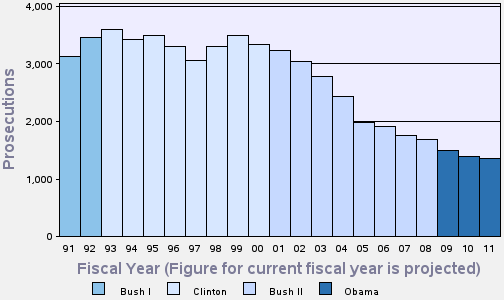

The pervasive fraud at the heart of the financial crisis has not slowed the steady, 13-year decline in the federal prosecution of financial institution fraud, reports TRAC. What forces are at play here?

The Nieman Watchdog Project asked TRAC co-director David Burnham what questions this data should raise for journalist. His suggestions:

Q. Over the years, the FBI has played a major federal role in white collar crime investigations. Have the FBI's growing responsibilities for investigating terrorism reduced the number of agents available to work on financial institutions fraud matters?

Q. Is the FBI's growing emphasis on terrorism and its declining interest on various kinds of white collar crime one of the hidden "costs" of 9/11?

Q. Are other agencies -- such as the IRS, SEC, etc -- picking up the slack?

Q. When it comes to measuring annual murder trends in the United States, the standard metric has long been the number of the bodies. Though not a perfect metric, it is a quite good way of determining the size of the problem on a year-by-year basis. News stories suggest a growth in financial institutions fraud. What is the value of this anecdotal information? Are there less anecdotal ways to track the trends? Does the steady decline in prosecutions mean that the problem is declining -- or that other forces are at work?

The pervasive fraud at the heart of the financial crisis has not slowed the steady, 13-year decline in the federal prosecution of financial institution fraud, reports TRAC. What forces are at play here?

|

|

|

|