IRS White Collar Crime Prosecutions Through June 2008

| Number Year-to-date | 609 |

|---|---|

| Percent Change from previous year | -3.6 |

| Percent Change from 5 years ago | 2.7 |

| Percent Change from 10 years ago | -25.4 |

| Percent Change from 20 years ago | -42.4 |

Table 1: Criminal White Collar Crime Prosecutions

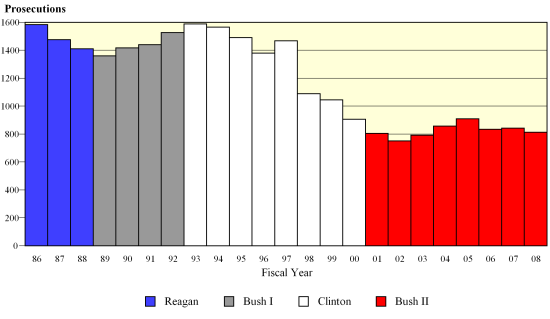

The latest available data from the Justice Department show that during the first nine months of fiscal 2008 the government reported 609 new white collar crime prosecutions referred by the IRS. If this activity continues at the same pace, the annual total of prosecutions will be 812 for this fiscal year. According to the case-by-case information analyzed by the Transactional Records Access Clearinghouse (TRAC), this estimate is down 3.6 percent over the past fiscal year when the number of prosecutions totaled 842.

|

| ||||||||||||||

|

||||||||||||||

The comparisons of the number of defendants charged with white collar crime-related offenses are based on case-by-case information obtained by TRAC under the Freedom of Information Act from the Executive Office for United States Attorneys (see Table 1).

Compared with five years ago when there were 791, the estimate of fiscal 2008 prosecutions of this type is up 2.7 percent. This is a notable contrast to the FBI, for which the 2,235 white collar prosecutions projected for fiscal 2008 are down 49 percent from the level of 4,382 five years ago.

IRS white collar prosecutions over the past year are still lower than they were ten years ago. Overall, the data show that prosecutions of this type are down 25.4 percent from the level of 1,088 reported in 1998 and down 42.4 percent from the level of 1,410 reported in 1988.

The long term trend in white collar crime prosecutions for these matters going back to fiscal 1988 is shown more clearly in Figure 1. The vertical bars in Figure 1 represent the number of white collar crime prosecutions of this type recorded each fiscal year. Projected figures for the current fiscal year are shown. Each presidential administration is distinguished by the color of the bars.

Leading Program Categories

Within the broad category of white collar crime, cases were classified by prosecutors into more specific types. Case types within white collar crime are listed below; an asterisk indicates those that were referred for prosecution by the IRS in fiscal 2008.

• Antitrust-Airlines |

• Antitrust-Banking |

• Antitrust-Defense Procurement |

• Antitrust-Extraterritorial |

• Antitrust-Other |

• Antitrust-Other Finance Mkts. |

• Fraud-Advance Fee Schemes* |

• Fraud-Against Ins. Provider* |

• Fraud-Arson for Profit |

• Fraud-Bankruptcy* |

• Fraud-Commodities |

• Fraud-Computer* |

• Fraud-Consumer* |

• Fraud-Corporate* |

• Fraud-Federal Procurement |

• Fraud-Federal Program* |

• Fraud-Financial Institution* |

• Fraud-Health Care* |

• Fraud-Identity Theft-Aggravated* |

• Fraud-Identity Theft-Other* |

• Fraud-Insider Ins. Provider |

• Fraud-Intellectual Property Violations |

• Fraud-MEWA/MET |

• Fraud-Other* |

• Fraud-Other Business* |

• Fraud-Other Insurance |

• Fraud-Other Investment* |

• Fraud-Securities* |

• Fraud-Tax* |

• Fraud-Telemarketing |

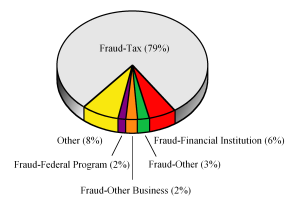

The single largest number of prosecutions of these matters through June 2008 was for "Fraud-Tax", accounting for 79.3 percent of prosecutions.

As shown in Figure 2, the second largest number of matters were prosecutions filed under the program area of "Fraud-Financial Institution" (5.9 percent). Next were "Fraud-Other" (2.6 percent), "Fraud-Other Business" (2.5 percent) and "Fraud-Federal Program" (1.6 percent). The "Other" category in Figure 2 is comprised of a diverse group of programs including "Fraud-Unspecified" (1.6 percent), "Fraud-Health Care" (1.1 percent) and "Fraud-Identity Theft-Other" (1.1 percent). See Figure 2.

Top Ranked Lead Charges

Table 2 shows the top lead charges recorded in IRS prosecutions of white collar crime matters filed in U.S. District Court during the first nine months of fiscal 2008. Note: There were an additional 40 other lead charges which were not individually ranked.

| Lead Charge | Count | Rank | 1 yr ago | 5 yrs ago | 10 yrs ago | 20 yrs ago | |

|---|---|---|---|---|---|---|---|

| 26 USC 7201 - Attempt to evade or defeat tax | 163 | 1 | 2 | 2 | 1 | 1 | More |

| 26 USC 7206 - Fraud and False statements | 153 | 2 | 1 | 1 | 2 | 2 | More |

| 18 USC 0371 - Conspiracy to commit offense or to defraud US | 56 | 3 | 3 | 3 | 4 | 5 | More |

| 18 USC 0287 - False, fictitious or fraudulent claims | 37 | 4 | 4 | 5 | 5 | 4 | More |

| 18 USC 0286 - Conspiracy to defraud the Government claims | 28 | 5 | 6 | 4 | 6 | 9 | More |

| 26 USC 7203 - Willful failure to file return, supply information | 26 | 6 | 5 | 7 | 3 | 3 | More |

| 18 USC 1341 - Mail Fraud - Frauds and swindles | 24 | 7 | 7 | 6 | 8 | 6 | More |

| 18 USC 1344 - Bank fraud | 20 | 8 | 10 | 8 | 13 | 17 | More |

| 31 USC 5324 - Structuring transactions to evade reporting requirement | 15 | 9 | 14 | 31 | 14 | 11 | More |

| 18 USC 1343 - Fraud by wire, radio, or television | 8 | 10 | 9 | 9 | 7 | 11 | More |

Table 2: Top charges filed

"Attempt to evade or defeat tax" (Title 26 U.S.C. section 7201) was the most frequently recorded lead charge. Title 26 U.S.C. section 7201 was ranked second a year ago, while it was the second most frequently invoked five years ago. It was ranked first ten years ago and first twenty years ago.

Ranked second in frequency was the lead charge "Fraud and False statements" under Title 26 U.S.C. section 7206. Title 26 U.S.C. section 7206 was ranked first a year ago, and it was also the most frequently invoked five years ago. It was ranked second ten years ago and second twenty years ago.

Ranked third was "Conspiracy to commit offense or to defraud US" under Title 18 U.S.C. section 371. Title 18 U.S.C. section 371 was ranked third a year ago, while it was the third most frequently invoked five years ago. It was ranked fourth ten years ago and fifth twenty years ago.

Among these top ten lead charges, the one showing the greatest projected increase in prosecutions—up 150 percent—compared with one year ago was Title 31 U.S.C. section 5324 that involves "Structuring transactions to evade reporting requirement". This was the same statute that had the largest projected increase—19.5 percent—when compared with five years ago.

Again among the top ten lead charges, the one showing the sharpest projected decline in prosecutions compared with one year ago—down 38.1 percent—was "Willful failure to file return, supply information" (Title 26 U.S.C. section 7203). This was the same statute that had the largest projected decrease—48.9 percent—when compared with five years ago.

Top Ranked Judicial Districts

During fiscal 2007 the Justice Department said the government obtained 2.8 white collar crime prosecutions for every one million people in the United States. If the pace during the first nine months of fiscal 2008 continues at the same rate, white collar crime prosecutions for one million people in the United States this year will be 2.7. Understandably, there is great variation in the per capita number of white collar crime prosecutions in each of the nation's ninety-four federal judicial districts

| Judicial District | Percapita | Count | Rank | 1yr ago | 5yrs ago | 10yrs ago | 20yrs ago | |

|---|---|---|---|---|---|---|---|---|

| W Virg, S | 17 | 12 | 1 | 44 | 9 | 9 | 74 | More |

| Okla, N | 10 | 7 | 2 | 7 | 7 | 11 | 48 | More |

| Montana | 8 | 6 | 3 | 4 | 28 | 33 | 28 | More |

| Utah | 8 | 16 | 4 | 47 | 75 | 61 | 31 | More |

| Tenn, W | 7 | 8 | 5 | 13 | 11 | 18 | 7 | More |

| Minnesota | 7 | 26 | 6 | 11 | 51 | 38 | 73 | More |

| N Dakota | 6 | 3 | 7 | 29 | 59 | 1 | 6 | More |

| Ga, M | 6 | 9 | 8 | 28 | 80 | 75 | 36 | More |

| Alaska | 6 | 3 | 9 | 61 | 4 | 5 | 4 | More |

| Penn, E | 6 | 24 | 10 | 3 | 48 | 28 | 5 | More |

Table 3: Top 10 districts (per one million people)

The Southern District of West Virginia (Charleston)—with 17.18 prosecutions as compared with 2.7 prosecutions per one million people in the United States—was the most active through June 2008.

The Northern District of Oklahoma (Tulsa) ranked second. The Northern District of Oklahoma (Tulsa) was ranked seventh a year ago as well as five years ago. The district's position ten years ago was eleventh and forty-eighth twenty years ago.

The District of Montana now ranks third. The District of Montana was ranked fourth a year ago. The district's position ten years ago was thirty-third and twenty-eighth twenty years ago.

Recent entries to the top 10 list were Minnesota, Western District of Tennessee (Memphis), Middle District of Georgia (Macon), North Dakota, Southern District of West Virginia (Charleston), Utah and Alaska, now ranked sixth, fifth, eighth, seventh, first, fourth and ninth. These districts ranked eleventh, thirteenth, twenty-eighth, twenty-ninth, forty-fourth, forty-seventh and sixty-first one year ago and fifty-first, eleventh, eightieth, fifty-ninth, ninth, seventy-fifth and fourth five years ago.

Compared with 10 years ago, Northern District of Oklahoma (Tulsa), Western District of Tennessee (Memphis), Eastern District of Pennsylvania (Philadelphia), Montana, Minnesota, Utah and Middle District of Georgia (Macon) now ranked in the top 10 did not appear in the top ten.

And compared with 20 years ago, Montana, Utah, Middle District of Georgia (Macon), Northern District of Oklahoma (Tulsa), Minnesota and Southern District of West Virginia (Charleston) were not sufficiently active to then make the top 10.

The federal judicial district which showed the greatest projected growth in the rate of white collar crime prosecutions compared with one year ago—707 percent—was Southern District of West Virginia (Charleston). Compared with five years ago, the district with the largest projected growth—1071 percent—was Middle District of Georgia (Macon) .

In the last year, the judicial District Court recording the largest projected drop in the rate of white collar crime prosecutions—16.4 percent—was Eastern District of Pennsylvania (Philadelphia).

See http://trac.syr.edu/ta/5/ for additional details on the prosecution of white collar crime by the IRS.