Internal Revenue Service Convictions for Fiscal 2008

Lead Charge: 31 USC 5324 - Structuring transactions to evade reporting requirement

Lead Charge: 31 USC 5324 - Structuring transactions to evade reporting requirement

| Number Year-to-date | 25 |

|---|---|

| Percent Change from previous year | 194 |

| Percent Change from 5 years ago | 317 |

| Percent Change from 10 years ago | 72.4 |

| Percent Change from 20 years ago | 355 |

Table 1: Criminal Convictions

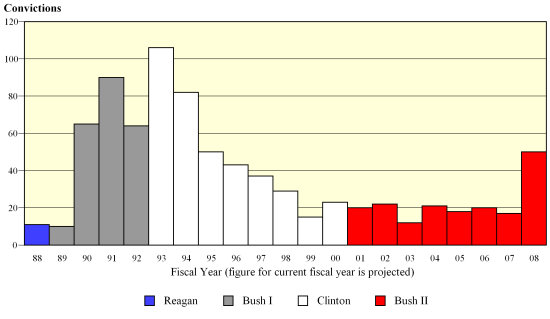

The latest available data from the Justice Department show that during the first six months of fiscal 2008 the government reported 25 new convictions for matters referred by the Internal Revenue Service with a lead charge of "31 USC 5324 - Structuring transactions to evade reporting requirement". If this activity continues at the same pace, the annual total of convictions will be 50 for this fiscal year. According to the case-by-case information analyzed by the Transactional Records Access Clearinghouse (TRAC), this estimate is up 194 percent over the past fiscal year when the number of convictions totaled 17.

|

| ||||||||||||||

|

||||||||||||||

The comparisons of the number of defendants convicted for offenses are based on case-by-case information obtained by TRAC under the Freedom of Information Act from the Executive Office for United States Attorneys (see Table 1).

Compared to five years ago when there were 12, the estimate of fiscal 2008 convictions of this type is up 317 percent. Convictions over the past year are much higher than they were ten years ago. Overall, the data show that convictions of this type are up 72.4 percent from the level of 29 reported in 1998 and up 355 percent from the level of 11 reported in 1988.

The long term trend in convictions for these matters going back to FY 1988 is shown more clearly in Figure 1. The vertical bars in Figure 1 represent the number of convictions of this type recorded each fiscal year. Projected figures for the current fiscal year are shown. Each presidential administration is distinguished by the color of the bars.

In contrast to these 25 convictions, during first six months of fiscal 2008 federal prosecutors turned down 75 additional referrals for which the IRS had recommended criminal prosecution with this recorded lead charge. Thus, for every successful prosecution, federal prosecutors refused to file prosecutions against three additional suspects IRS referred. The most frequent reason given by U.S. Attorney offices for refusing to go forward with IRS prosecution recommendations was that there was "weak or insufficient admissible evidence." For others, prosecutors felt there was a "lack of evidence of criminal intent," or "no federal offense was evident," or "minimal federal interest or no deterrent value." Only two were turned down because of the "lack of prosecutive resources."

In general, the IRS has had less success in getting referrals prosecuted that were classified under this lead charge than for tax evasion, fraud and false statements, and other charges under Title 26 of the U.S. Code.

Leading Program Areas

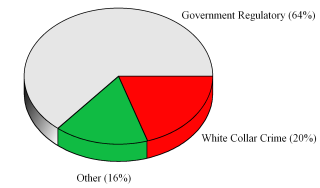

Cases were classified by prosecutors into more specific types. The single largest number of convictions of these matters through March 2008 was for "Government Regulatory", accounting for 64 percent of convictions. See Figure 2.

The second largest number of matters were Convictions filed under the program area of "White Collar Crime " (20 percent) . The "Other" category in Figure 2 is comprised of a diverse group of programs. The largest specific program within the "Other" category was "Narcotics/Drugs" (8 percent).

Ranked Judicial Districts

Table 2: District Listing |

Convictions of this type have been registered for 17 of the nation's 94 judicial districts during the first six months of fiscal 2008. Those districts are listed in Table 2.

|