Tax Evasion Prosecutions for Fiscal Year 2007

Lead Charge: 26 USC 7201 - Attempt to evade or defeat tax

Lead Charge: 26 USC 7201 - Attempt to evade or defeat tax

| Number Year-to-date | 196 |

|---|---|

| Percent Change from previous year | -5.3 |

| Percent Change from 5 years ago | -8.4 |

| Percent Change from 10 years ago | -49.4 |

| Percent Change from 20 years ago | -68.7 |

Table 1: Criminal Prosecutions

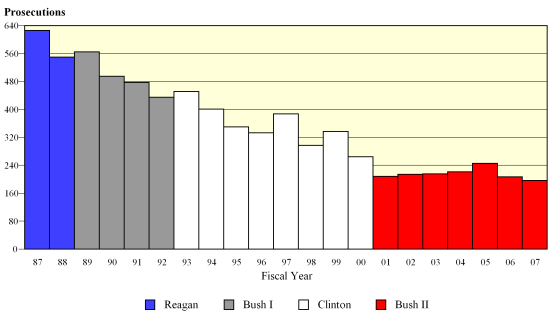

The latest available data from the Justice Department show that during FY 2007 the government reported 196 new prosecutions with a lead charge of "26 USC 7201 - Attempt to evade or defeat tax". According to the case-by-case information analyzed by the Transactional Records Access Clearinghouse (TRAC), this number is down 5.3% over the past fiscal year when the number of prosecutions totaled 207.

|

| ||||||||||||||

|

||||||||||||||

The comparisons of the number of defendants charged with offenses are based on case-by-case information obtained by TRAC under the Freedom of Information Act from the Executive Office for United States Attorneys (see Table 1).

The trend in criminal prosecutions under this lead charge has been consistently downward for at least two decades. For example, when this number of FY 2007 prosecutions of this type is compared with those five years ago when there were 214, the number of prosecutions is down 8.4 percent. Prosecutions over the past year are much lower when compared to ten and twenty years ago. Overall, the data show that prosecutions of this type are down 49.4 percent from the level of 387 reported in 1997 and down 68.7 percent from the level of 626 reported in 1987. Or stated another way, the level of prosecutions today are only half what they were ten years ago and less than one-third the level they were two decades ago.

The long term trend in prosecutions for these matters going back to FY 1987 is shown more clearly in Figure 1. The vertical bars in Figure 1 represent the number of prosecutions of this type recorded each fiscal year. Each presidential administration is distinguished by the color of the bars.

Leading Program Areas

Cases were classified by prosecutors into more specific types. During fiscal year 2007 all but one prosecution was termed a "White Collar Crime" offense. The remaining prosecution was classified under the "Narcotics/Drug" program area.

Last year was unusual in not having any other types of cases. For example, during FY 2006 there were three "Official Corruption" prosecutions, five "Government Regulatory" prosecutions, and even one case categorized as a "Domestic Terrorism Type" due to a concern for potential confrontations. Twenty years ago, it was also more common to see drug offenses prosecuted under this statute.

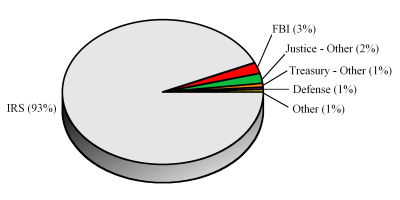

Figure 2: Prosecutions by Investigative Agency

Leading Investigative Agencies

The Internal Revenue Service was -- as one might expect -- the lead investigative agency for most prosecutions under this statute. The IRS accounted for 93.4 percent of prosecutions referred during FY 2007. See Figure 2.

The Justice Department accounted for the next largest group of ten referrals, including five from the Federal Bureau of Investigation. Two prosecution referrals came from other Treasury agencies, and one came from the Office of Inspector General of the Defense Department.

While most of the decline in prosecutions over the last twenty years has been because of a lower volume of referrals from the Internal Revenue Service, the declines were not limited to the IRS. Twenty years ago, for example, the referrals from the Justice Department accounted for 47 prosecutions rather than merely the ten last year.

Top Ranked Judicial Districts

Understandably, there is great variation in the number of prosecutions in each of the nation's ninety-four federal judicial districts. The districts registering the largest number of prosecutions with "attempt to evade or defeat the tax" as the recorded lead charge during the first twelve months of FY 2007 are shown in Table 2.

Table 2: Top 10 districts |

Thirty out of the 94 federal judicial districts had not a single prosecution recorded under 26 USC 7201 during all of fiscal year 2007. Clicking on the "More" link will give you the opportunity to obtain a report targeted to the prosecution of these matters in the Judicial District indicated in the table. See this page for a complete list of other judicial districts recording prosecutions last year under 26 USC 7201. |