Securities/Commodities/Exchange Civil Filings

Jump 43 Percent in March 2014

Number Latest Month 93 Percent Change from previous month 43.1% Percent Change from 1 year ago -12.6% Percent Change from 5 years ago -47.1%

Table 1. Securities/Commodities/Exchange

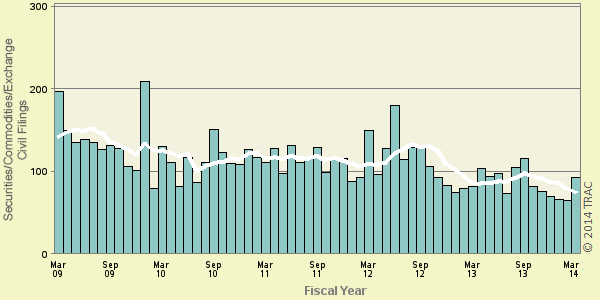

Civil FilingsThe latest available data from the federal courts show that during March 2014 the government reported a 43 percent jump in new securities/commodities/exchange civil filings. According to the case-by-case information analyzed by the Transactional Records Access Clearinghouse (TRAC), there were 93 new filings in March, up from 65 in February. It is too soon to tell whether this was a one-time increase, or marks the end of a general decline in filings that has occurred over the last 18 months.

The comparisons of the number of civil filings for securities/commodities/exchange-related suits are based on case-by-case court records which were compiled and analyzed by TRAC (see Table 1). Suits in this category involve alleged violations of the Securities and Exchange Act (15 USC 78), securities fraud under 15 USC 77 and 12 USC 22, violations of commodities exchange regulations and other breaches of fiduciary duties.

When monthly 2014 civil filings of this type are compared with those of the same period in the previous year, their number was down 12.6 percent. These civil filings for March 2014 are lower than they were for the same period five years ago. Overall, the data show that civil filings of this type are down 47.1 percent from levels reported in March 2009.

The long term trend in securities/commodities/exchange civil filings going back five years is shown more clearly in Figure 1. The vertical bars in Figure 1 represent the number of securities/commodities/exchange civil filings recorded each month. The superimposed line on the bars plots the six-month moving average so that natural fluctuations are smoothed out. One-year and five-year change comparisons are based upon the moving averages.

Top Ranked Judicial Districts

Understandably, there is great variation in the number of securities/commodities/exchange civil filings in each of the nation's ninety-four federal judicial districts.

Judicial District Count Rank 1yr ago 5yrs ago N. Y., S 11 1 1 1 Cal, N 8 2 3 2 N. J. 8 2 15 8 Texas, S 8 2 8 22 Cal, C 7 5 3 3 Utah 4 6 8 5 Oregon 4 6 - 22 Penn, E 3 8 15 10 Ill, N 3 8 5 10 La, W 2 10 15 - Conn 2 10 8 22 S Car 2 10 - - Minnesota 2 10 - - Ga, N 2 10 - 10 Arizona 2 10 - 15 Mass 2 10 2 22 Texas, N 2 10 - 8 Fla, S 2 10 8 7 Fla, M 2 10 15 13

Table 2. Top Ranked Districts

The Southern District of New York — with 11 civil filings — was the most active through March 2014. The Southern District of New York was ranked first a year ago as well as five years ago.

The Northern District of California, the District of New Jersey and the Southern District of Texas all tied for a second-place ranking. The Northern District of California was ranked third a year ago, while it was ranked second five years ago. The Southern District of Texas was ranked eighth a year ago.

The federal judicial district which showed the greatest growth in securities/commodities/exchange civil filings compared to one year ago — 700.0 percent — was New Jersey. Compared to five years ago, the district with the largest growth — 700.0 percent — was Southern District of Texas .

In the last year, the judicial District Court recording the largest drop in securities/commodities/exchange civil filings — 77.8 percent — was Massachusetts. But over the past five years, the Southern District of New York showed the largest drop — 85.3 percent.

Each month, TRAC offers a free report focused on one area of civil litigation in the U.S. district courts. In addition, subscribers to the TRACFed data service can generate custom reports by district, office, nature of suit or federal jurisdiction via the TRAC Data Interpreter.

Report Date: May 8, 2014